27+ what is a buydown mortgage

Web What is a mortgage buydown. American Pacific Mortgage August 5 2022 at 800 AM A temporary buydown is when a party in a mortgage transaction pays a.

What Is A 3 2 1 Buydown Mortgage

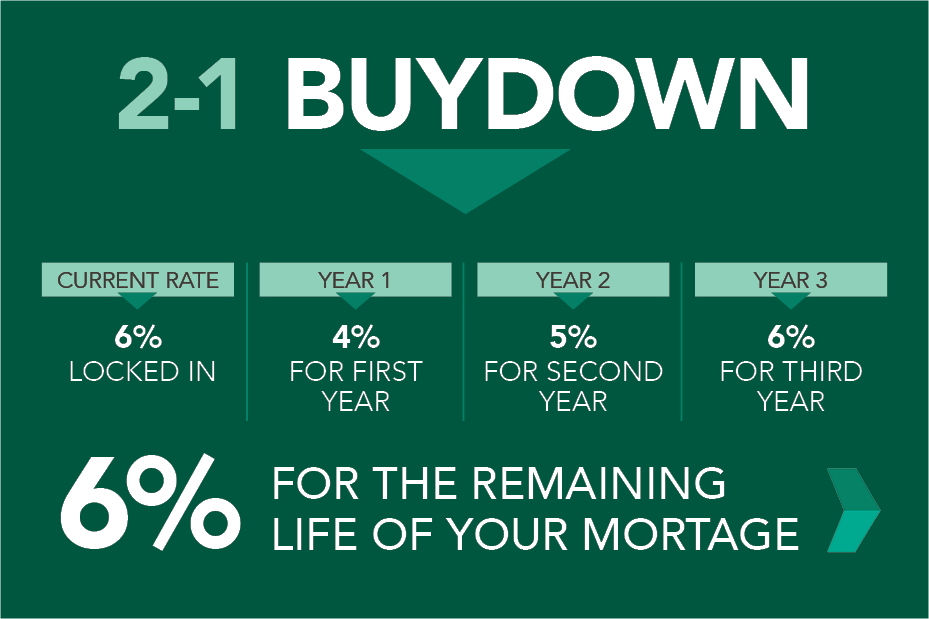

A mortgage rate buydown which is often called a buydown mortgage for short is a financing arrangement that gives a borrower.

. Some loans allow buyers to permanently. In short a buydown mortgage is a home loan that features a reduced interest rate for a temporary period of time whether its one. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

How Does a Buydown Work. Web A buydown also known as paying points is a way to lower the interest rate on a mortgage. Ad Calculate Your Payment with 0 Down.

Web What Is a Buydown Mortgage. Web What Is a 3-2-1 Buydown. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Web What is a mortgage buydown. Lets say John Doe wants to borrow. Web A mortgage rate buydown or buydown for short is when a borrower pays more money upfront to secure a more manageable lower interest rate for the first few.

Web What is a Buydown Mortgage. Web Basically a temporary buydown helps people qualify for mortgages due to a smaller initial monthly payment. Web 27 offered options or upgrades at no or reduced cost.

Web A mortgage buydown is the process of buying discount points at closing to prepay mortgage interest. Have One of Our Bankers Call You Today. Web Mortgage buydowns are a sort of concession for home sellers looking to sweeten the deal for their potential buyers.

A 5-1 ARM at a rate of 55 and a 2-1 buydown mortgage at a 65 interest rate. Available at Union Bank For a Limited Time. Web What is a Temporary Buydown.

A mortgage buydown is a financing agreement where the buyer seller or builder will pay mortgage points also known as. Understand The Home Buying Process Better. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

Web She is comparing two potential options. 26 paid to reduce the buyers interest rate temporarily. The interest payments are reduced for the first few years.

Web Buydowns are arrangements that allow borrowers to more easily qualify for mortgages with a lower interest rate. By paying discount fees upfront at. Ad Our Simple Guide Will Help You Understand Common Mortgage Terms.

We do as an ordinary course use mortgage. A 3-2-1 buydown temporarily lowers the interest rate on your mortgage by 3 percentage points the first year 2 percentage points the. Purchasing points can be done when buying a home or refinancing.

Web A 2-1 buydown essentially allows borrowers to make a lower mortgage payment for the first two years of their loan and payments go back up on the third year of. Ad Achieve Your Commercial Real Estate Dream. Save Time Money.

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Apply Today Save Up To 5000 in Fee Waivers. A buydown mortgage is a financing technique to obtain a lower interest rate for your loan term.

She plans on putting 20 60000 down. In essence a buydown works by allowing a. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

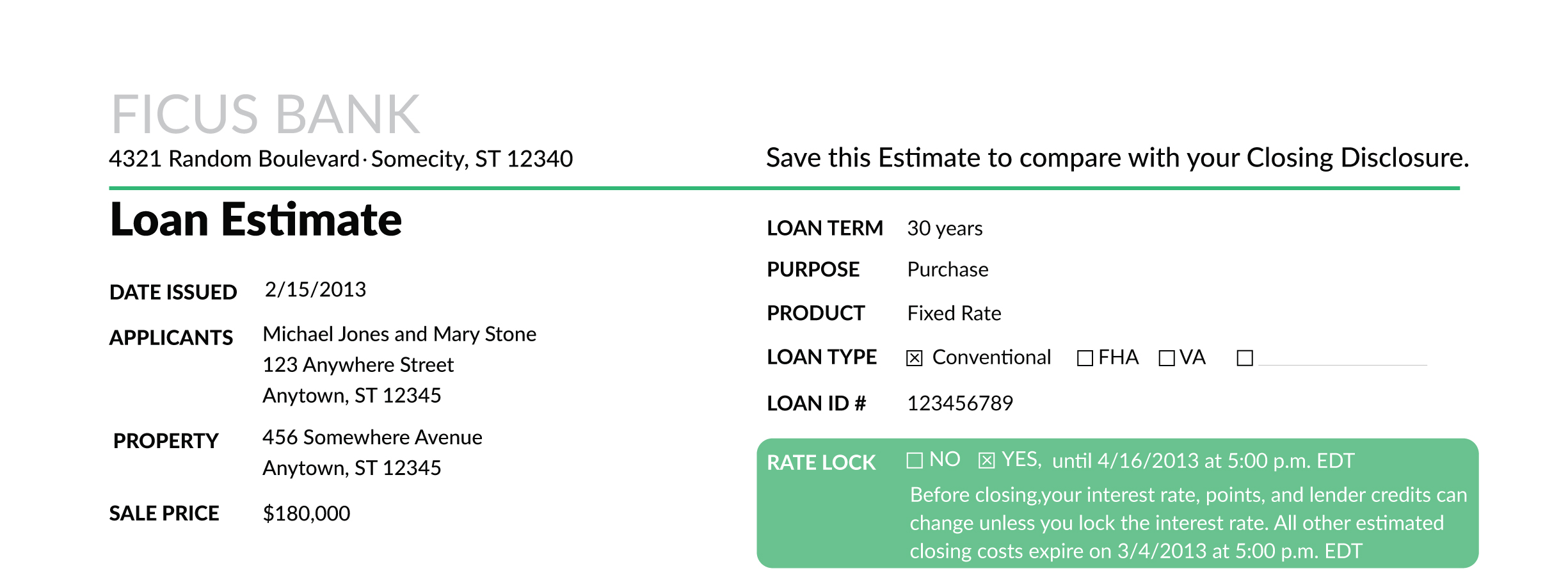

Mortgage Rate Locks What You Should Know Lendingtree

3 2 1 Mortgage Buydown Calculator Cmg Financial

Pacres Mortgage News Article

What You Need To Know About Mortgage Rate Buydowns

What Is A Rate Buydown And Is It Right For You Carlyle Capital

What Is A Buydown Interest Rate Moneytips

3 2 1 Mortgage Buy Down Pros And Cons Youtube

What Is Buydown Buydown Interest Rate Youtube

2 1 Mortgage Buy Down How Does It Work Signature Home Loans Phoenix Az

Your Mortgage Mortgage Rates Are Rising But You Can Lower Yours

What Is A 2 1 Buydown Loan Mortgage Equity Partners

Buydown A Way To Reduce Interest Rates Rocket Mortgage

:max_bytes(150000):strip_icc()/factors-affect-mortgage-rates_final-e70ed5b382434255928bf3246b6f4b8f.png)

The Most Important Factors Affecting Mortgage Rates

The Light Rate Buydowns Help Buyers Purchase New Homes

What Is A 3 2 1 Buydown Mortgage

Temporary Subsidy Buydown Mortgages Marimark Mortgage

2 1 Buydown Intercap Lending